Business Insurance in and around Stonecrest

One of Stonecrest’s top choices for small business insurance.

This small business insurance is not risky

This Coverage Is Worth It.

Do you own a stained glass shop, a tailoring service or a hearing aid store? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on making this adventure a success.

One of Stonecrest’s top choices for small business insurance.

This small business insurance is not risky

Strictly Business With State Farm

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Kim Mays. With an agent like Kim Mays, your coverage can include great options, such as commercial auto, artisan and service contractors and worker’s compensation.

Since 1935, State Farm has helped small businesses manage risk. Call or email agent Kim Mays's team to explore the options specifically available to you!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

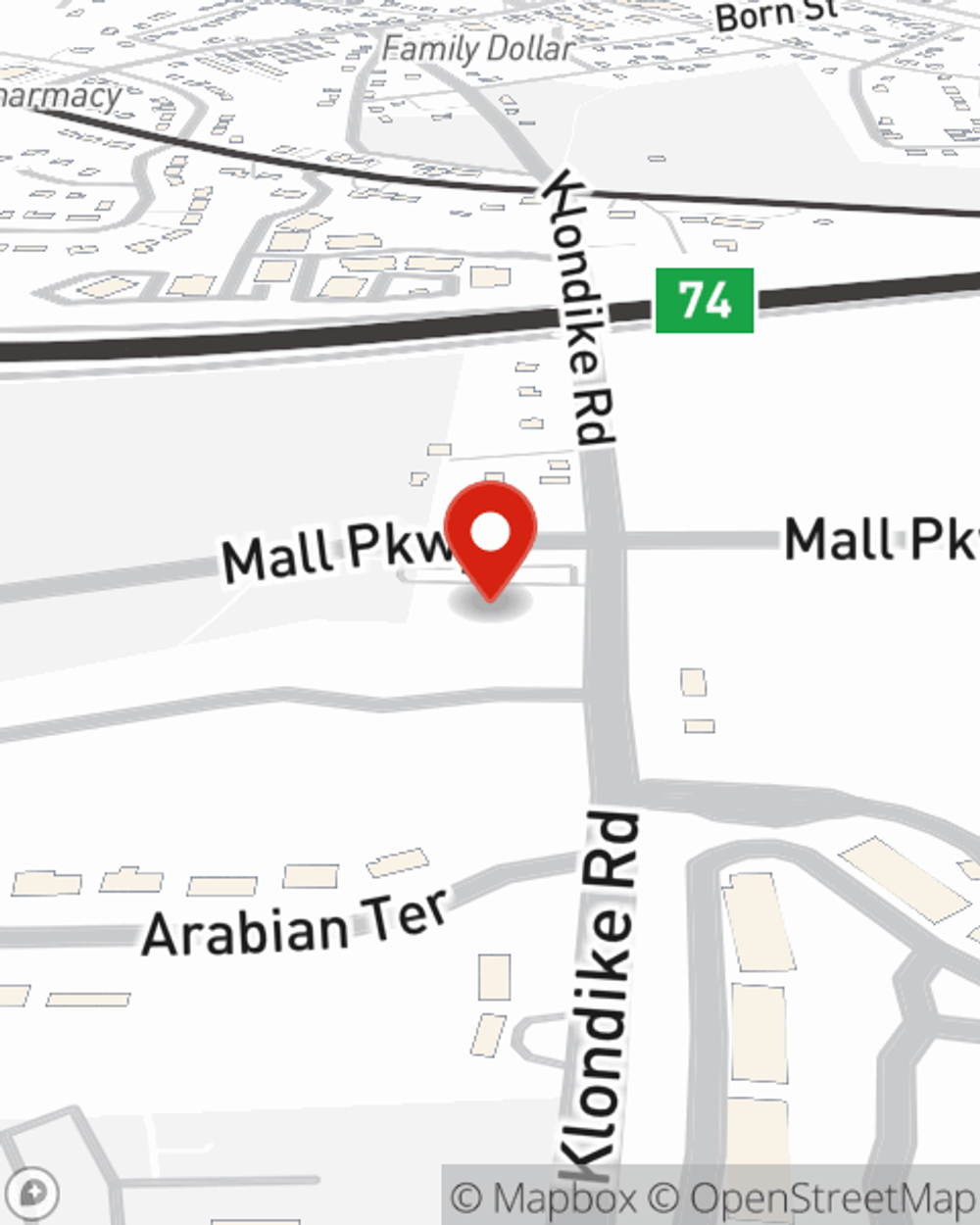

Kim Mays

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.